Welcome to the world of business accounting programs! Whether you’re a small business owner or a seasoned entrepreneur, investing in a reliable accounting software can streamline your financial processes, save you time, and help you make informed decisions to grow your business. By unlocking the benefits of a business accounting program, you can track expenses, manage invoices, monitor cash flow, and generate reports with ease. Say goodbye to manual bookkeeping and tedious spreadsheets, and say hello to efficiency and accuracy in managing your finances.

Importance of Business Accounting Program

Business accounting is an essential aspect of any successful organization. It involves keeping track of financial transactions, analyzing data, and preparing reports that provide valuable insights into the company’s financial health. A business accounting program is a software tool that helps streamline and automate these processes, making it easier for businesses to manage their finances effectively. Here are a few reasons why a business accounting program is crucial for the success of any organization.

First and foremost, a business accounting program helps businesses maintain accurate financial records. By automating the process of recording and categorizing transactions, businesses can ensure that their financial data is always up-to-date and free from errors. This level of accuracy is essential for making informed decisions about the company’s finances and for complying with tax laws and regulations.

Another important function of a business accounting program is its ability to generate financial reports. These reports provide valuable insights into the company’s performance, allowing business owners and managers to identify areas of strength and weakness. By analyzing these reports, businesses can make adjustments to their operations to improve profitability and sustainability.

Additionally, a business accounting program can help businesses track their cash flow and manage their expenses more effectively. By providing real-time updates on income and expenses, businesses can make strategic decisions about how to allocate resources and prioritize spending. This can help businesses avoid cash flow issues and ensure that they have enough funds to cover their operating costs.

Furthermore, a business accounting program can help businesses streamline their financial processes and increase efficiency. By automating tasks such as invoicing, payroll processing, and expense tracking, businesses can save time and resources that can be allocated to other areas of the business. This increased efficiency can lead to cost savings and improved productivity, ultimately contributing to the overall success of the organization.

In conclusion, a business accounting program plays a crucial role in helping businesses manage their finances effectively and make informed decisions about their operations. By maintaining accurate financial records, generating insightful reports, tracking cash flow, and increasing efficiency, a business accounting program can help businesses achieve their financial goals and ensure long-term success. Investing in a quality accounting program is essential for any organization that wants to thrive in today’s competitive business environment.

Key Features of a Good Accounting Program

Choosing the right accounting program for your business is crucial in managing your finances effectively. Here are some key features that you should look for in a good accounting program:

1. User-Friendly Interface: A good accounting program should have a simple and intuitive user interface that makes it easy for even non-accountants to navigate. Look for a program that has an organized layout, clear labels, and easy-to-use features.

2. Customizable Reporting: One important feature to look for in an accounting program is customizable reporting. This feature allows you to create reports tailored to your specific business needs. Whether you need to track expenses by department, analyze sales by product category, or monitor cash flow by month, customizable reporting gives you the flexibility to adapt the program to your unique requirements. In addition, the ability to save custom report templates can save you time and provide valuable insights into your financial data.

3. Integration Capabilities: A good accounting program should be able to integrate with other software applications that you use in your business, such as payroll systems, CRM software, or inventory management tools. Integration capabilities streamline your workflows, reduce manual data entry, and ensure that your financial data is accurate and up-to-date across all platforms.

4. Automation Features: Look for an accounting program that offers automation features such as scheduled transactions, recurring invoices, and bank feeds. These features save you time by automating repetitive tasks and reducing the risk of human error. Automation also improves efficiency and ensures that your financial records are always current.

5. Scalability: As your business grows, your accounting needs will evolve. A good accounting program should be scalable to accommodate your changing requirements. Look for a program that can handle increased transaction volumes, additional users, and expanded reporting capabilities as your business expands.

6. Security Measures: Protecting your financial data is essential in today’s digital age. Make sure the accounting program you choose offers robust security measures such as data encryption, password protection, and multi-factor authentication. Regular software updates and data backups are also important in preventing data loss and unauthorized access to your financial information.

7. Customer Support: Lastly, consider the level of customer support offered by the accounting program provider. Look for a company that provides responsive customer support through phone, email, or live chat. A knowledgeable support team can help you troubleshoot issues, answer questions, and ensure that you are making the most of your accounting program.

By considering these key features, you can select a good accounting program that meets the needs of your business and helps you manage your finances more effectively. Whether you are a small startup or a growing enterprise, investing in the right accounting software can save you time, reduce errors, and provide valuable insights into your financial performance.

Benefits of Implementing Accounting Software

Implementing accounting software in a business can bring about a wide range of benefits that can significantly improve the financial management and overall efficiency of the organization. In this article, we will discuss the key advantages of using accounting software to streamline your business operations.

1. Improved Accuracy and Efficiency: Accounting software eliminates the need for manual data entry and calculations, reducing the chances of human error. This helps in maintaining accurate financial records and streamlining the accounting processes. With automation features such as automatic calculations, it saves time and increases efficiency by eliminating repetitive tasks.

2. Time-Saving: By automating various accounting processes, software can save time spent on manual data entry, reconciliation, and generating financial reports. This allows accounting staff to focus on more strategic tasks that add value to the business, such as financial analysis and decision-making.

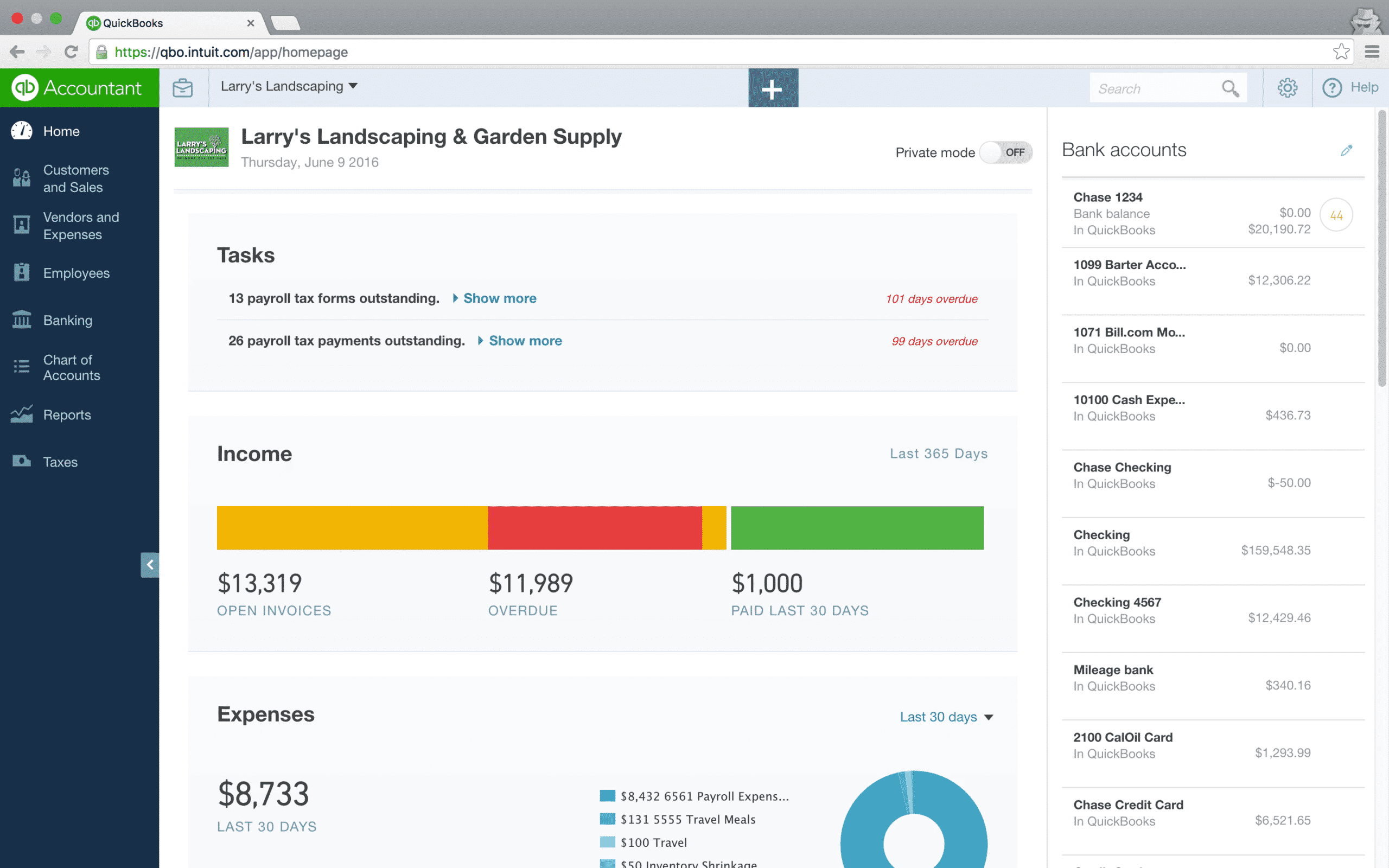

3. Enhanced Financial Visibility: Accounting software provides real-time access to financial data, allowing businesses to track their financial performance and make informed decisions. With features like customizable dashboards and reports, users can quickly identify trends, monitor cash flow, and analyze key performance indicators. This enhanced financial visibility helps businesses to make timely adjustments and strategic decisions to improve profitability.

4. Compliance and Security: Accounting software helps in ensuring compliance with financial regulations and standards by providing tools to keep track of transactions, taxes, and financial statements. It also offers security features such as data encryption and user access controls to protect sensitive financial information from unauthorized access. This reduces the risk of fraud and errors, providing peace of mind to business owners and stakeholders.

5. Cost-Effective: While there is an initial investment in purchasing and implementing accounting software, the long-term benefits outweigh the costs. By saving time, reducing errors, and improving efficiency, businesses can save money on labor costs and operational expenses. Additionally, accounting software helps in identifying cost-saving opportunities and optimizing financial processes to increase profitability.

6. Scalability and Integration: Accounting software can be easily scaled to accommodate the growth of a business, whether it’s in terms of transactions volume or expanding to new markets. Most accounting software also integrates with other business systems such as CRM, inventory management, and payroll, allowing for seamless data flow and communication between departments. This integration eliminates manual data entry and improves collaboration across the organization.

In conclusion, implementing accounting software in a business can bring numerous benefits such as improved accuracy, time savings, enhanced financial visibility, compliance, cost-effectiveness, scalability, and integration. By leveraging the capabilities of accounting software, businesses can optimize their financial management processes and make informed decisions to drive growth and success.

How to Choose the Right Accounting Program for Your Business

Choosing the right accounting program for your business is a crucial decision that can significantly impact the efficiency and effectiveness of your financial operations. With so many options available in the market, it can be overwhelming to decide which one is best suited for your specific needs. Here are some tips to help you choose the right accounting program for your business:

1. Understand Your Business Needs: Before you start looking for an accounting program, take the time to assess your business needs. Consider the size of your business, the complexity of your financial operations, and the specific features you require in an accounting solution. By understanding your needs, you can narrow down your options and focus on programs that align with your requirements.

2. Consider Scalability: As your business grows, so will your accounting needs. It is important to choose an accounting program that can scale with your business and accommodate future growth. Look for a program that offers scalability options, such as the ability to add more users, features, or storage space as needed.

3. Evaluate Features and Functionality: Different accounting programs offer different features and functionalities. Some programs may focus on basic bookkeeping tasks, while others may offer more advanced features such as inventory management, project tracking, or payroll processing. Make a list of the features that are essential for your business, and prioritize programs that offer those features.

4. Consider Ease of Use: One of the most important factors to consider when choosing an accounting program is its ease of use. A user-friendly interface and intuitive navigation can significantly impact the adoption and efficiency of the program within your organization. Look for programs that offer a simple and straightforward design, with clear instructions and easy access to key functions.

5. Check Compatibility and Integration: It is important to choose an accounting program that is compatible with your existing systems and can easily integrate with other software applications used in your business. Consider whether the program can integrate with your CRM, inventory management, or e-commerce platforms to streamline your operations and improve data accuracy.

6. Consider Security and Compliance: Financial data is sensitive information that needs to be protected from unauthorized access and cyber threats. Make sure the accounting program you choose offers robust security features, such as data encryption, user permissions, and regular backups. Additionally, ensure that the program complies with relevant regulations and industry standards to avoid potential legal issues.

7. Seek Recommendations and Read Reviews: Before making a final decision, seek recommendations from other business owners or financial professionals who have experience with different accounting programs. Reading online reviews and testimonials can also provide valuable insights into the pros and cons of a specific program. Take the time to research and compare different options to make an informed decision.

By following these tips, you can select the right accounting program that meets your business needs, enhances efficiency, and helps you make informed financial decisions. Remember to regularly evaluate the performance of the program and make adjustments as needed to ensure its continued effectiveness in managing your business finances.

Best Practices for Using a Business Accounting Program

When it comes to using a business accounting program, there are several best practices that can help you make the most of the software and ensure accurate financial records. Here are five key tips to keep in mind:

1. Set Up Properly: It is essential to set up your accounting program correctly from the beginning. This includes inputting all necessary information such as chart of accounts, vendors, and customers. Take the time to customize the settings to fit your business needs and ensure accurate financial reporting.

2. Regularly Reconcile: One of the best practices for using a business accounting program is to reconcile your bank and credit card accounts on a regular basis. This will help you catch any discrepancies or errors early on and ensure that your financial records are accurate.

3. Automate Processes: Take advantage of the automation features in your accounting program to streamline tasks such as invoicing, bill payments, and payroll. This will save you time and reduce the risk of errors that can occur with manual data entry.

4. Back Up Regularly: It is crucial to regularly back up your accounting data to prevent loss in the event of a computer crash or other technical issues. Most accounting programs offer the option to back up data to the cloud or an external hard drive, so be sure to take advantage of this feature.

5. Stay Up-to-Date with Training: To get the most out of your accounting program, it is important to stay up-to-date with training and updates. Many programs offer online tutorials, webinars, and customer support to help you navigate new features and troubleshoot any issues that may arise. By continuously learning and improving your skills, you can maximize the benefits of your accounting software.

By following these best practices for using a business accounting program, you can ensure accurate financial records, streamline processes, and make informed business decisions. Take the time to set up your software properly, reconcile accounts regularly, automate tasks, back up data, and stay up-to-date with training to make the most of your accounting program.